Formycon Shares

Shares

Creating value with biosimilars

With the commercialization of the next approved biosimilar assets and the continuous expansion of its own development pipeline, Formycon has its sights set on growth and sustainable profitability.

Formycon AG

Share Chart

Basic

Information

| Legal Form | German Stock Corporation (Aktiengesellschaft) |

| Initial Exchange Listing | December 20, 2010 |

| ISIN | DE000A1EWVY8 |

| WKN | A1EWVY |

| Exchange and Market Segment | Regulated Market (Prime Standard) SDAX |

| Trading Venues | Xetra, Berlin, Düsseldorf, Frankfurt, Hamburg, Munich, Stuttgart, Tradegate |

| Share Type | Bearer shares without par value |

| Registered Capital | EUR 17,672,927.00 |

| Shares Outstanding | 17,672,927 Bearer shares |

| Designated Sponsors | Oddo BHF Corporates & Markets AG M.M. Warburg & Co |

Shareholder

Structure

Structure as of November 11, 2024

This overview reflects the voting rights notifications pursuant to §§ 33ff of the German Securities Trading Act (Wertpapierhandelsgesetz – WpHG). The individual notifications can be found here.

Analyst

Ratings

| Analyst | Recommendation | Target price in € | Date of latest Research Report |

|---|---|---|---|

| Berenberg | buy | 30,0 | 11/24/2025 |

| First Berlin | buy | 53,0 | 11/20/2024 |

| Hauck & Aufhäuser | buy | 46,0 | 06/27/2025 |

| H.C. Wainwright | buy | 40,0 | 11/19/2025 |

| Kepler Cheuvreux | buy | 33,0 | 11/18/2025 |

| B. Metzler seel. Sohn & Co. | buy | 35,0 | 08/15/2025 |

| mwb [→ Research Formycon AG] | buy | 48,0 | 11/13/2025 |

| Oddo BHF | Neutral | 38,0 | 11/13/2025 |

| Royal Bank of Canada | Outperform | 51,0 | 11/17/2025 |

| M.M. Warburg & Co | buy | 40,0 | 06/17/2025 |

| Average Target Price | 41,4 | 11/24/2025 |

Formycon is covered and evaluated by the analysts mentioned above. Please note that any opinions, estimates or forecasts regarding Formycon’s performance made by these analysts are theirs alone and do not represent opinions, estimates or forecasts of Formycon or its management. The above reference to the analysts does not imply that Formycon endorses their opinions. Formycon is under no obligation to update or supplement the information provided above and does not guarantee the accuracy or completeness of this list.

Analysten Consensus

■ 24,05 % Santo Holding (Deutschland) GmbH, Thomas Peter Maier

■ 13,26 % Wpart GmbH, Wen.Co Invest GmbH, Peter Wendeln

■ 9,08 % Richter Gedeon Vegyészeti Gyár Nyilvánosan Müködö Rt. (Gedeon Richter)

■ 6,04 % Active Ownership Fund SICAV SIF SCS, Klaus Röhrig, Florian Schuhbauer

■ 5,10 % Detlef und Ursula Spruth

■ 3,28 % Stefan Reichensperger

■ 39,19 % Streubesitz

Blog

Blog

Formycon CFO Enno Spillner interviewed by Andreas Schmidt from the SdK

March 07, 2025

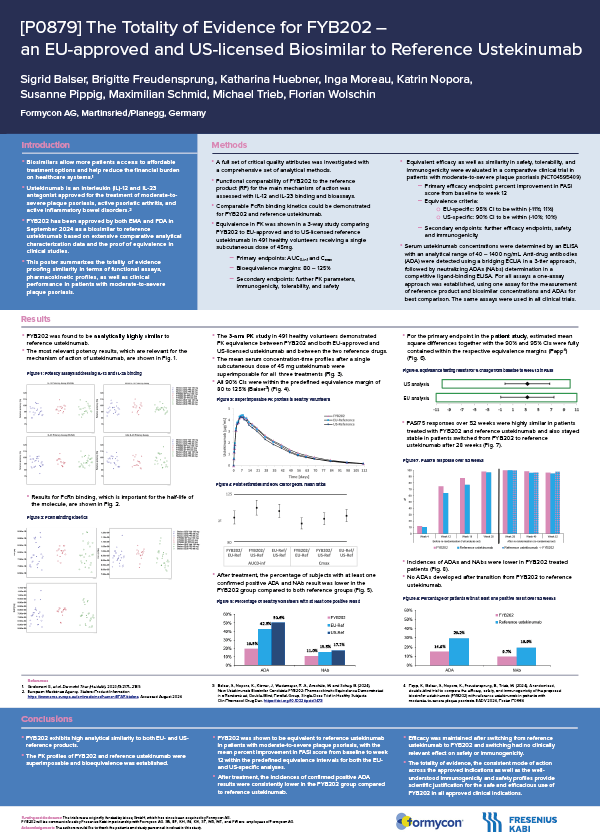

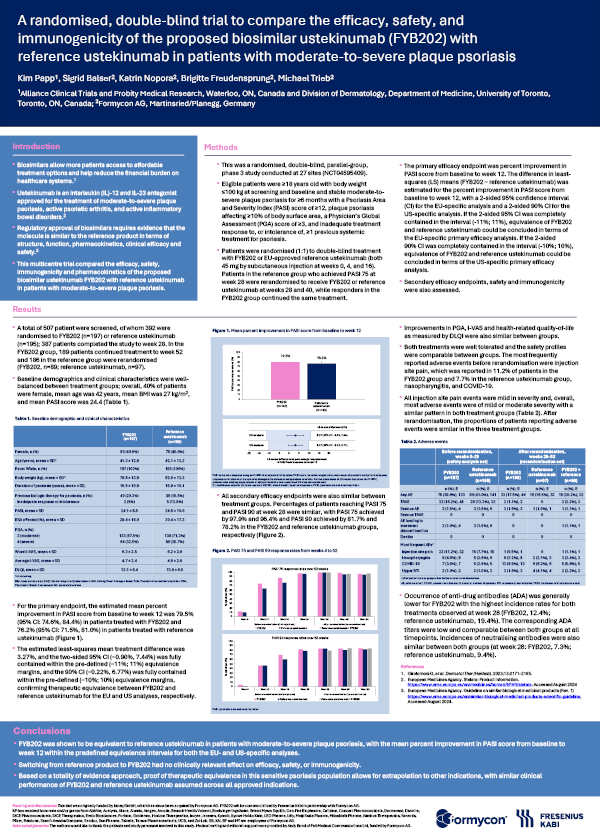

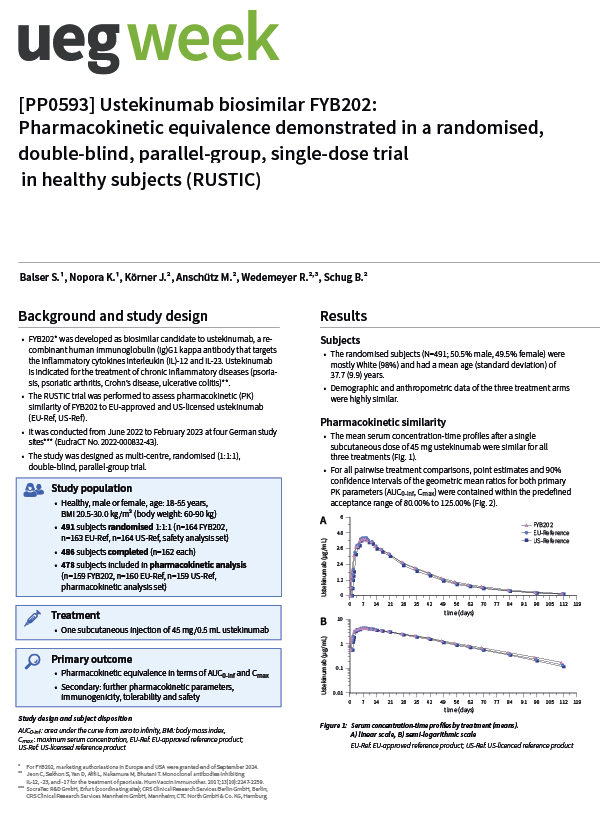

In a video interview with Andreas Schmidt from Schutzgemeinschaft der Kapitalanleger e.V. (SdK), Enno Spillner explains why Formycon can waive the phase III trial for the pembrolizumab biosimilar candidate FYB206. He also addresses the current dynamics on the US biosimilar market, which have led to reduced sales expectations for the ustekinumab biosimilar FYB202 and the temporary pause in the commercialization of the ranibizumab biosimilar FYB201 in the U.S.

The interview is held in German.

You are currently seeing a placeholder content of YouTube. To access the actual content, click on the button below. Please note that data will be passed on to third-party providers.

More informationUpdate on Biosimilar Projects and US Market Dynamics

February 17, 2025

The Management Board of Formycon AG presented recent developments in various biosimilar projects in a webcast. The replay of the webcast can be accessed via the following link: Formycon Update February 2025.

2024 in a nutshell

January 6, 2025

2024 was a special year for Formycon. With a brief look back at the operational highlights of the last 12 months, we wish you a good start to a healthy, happy, successful and, above all, peaceful 2025.

mwb-research Roundtable

December 12, 2024

In the mwb Research Roundtable, we look back on an extremely successful year for Formycon – on the numerous operational milestones as well as on the successful capital market strategy that will lead us into the SDAX in December 2024. Following a short presentation, the Executive Board of Formycon AG answers questions from the audience. The Roundtable is held in German.

You are currently seeing a placeholder content of YouTube. To access the actual content, click on the button below. Please note that data will be passed on to third-party providers.

More informationGrowth and future of biotechnology: opportunities through biosimilars

Guest article in the Bio Deutschland Yearbook 2024/2025 (in German only)

Enno Spillner

Chief Financial Officer (CEO)

Formycon AG

Vor 20 Jahren war die Biotechnologie-Landschaft in Deutschland noch deutlich überschaubarer und BIO Deutschland begann als kleine Organisation mit relativ wenigen Mitgliedern aus der klassischen roten Biotechnologie. Wie die Branche, hat sich auch der Verband seitdem stark entwickelt und diversifiziert. Auch Formycon als Biosimilar-Spezialist gehört dazu und leistet seinen Beitrag zu Know-how, Investitionen und Wachstum.

Die Biotechnologie in Deutschland steht heute vor drei großen Herausforderungen: einem hohen Innovationsdruck, steigenden Kosten im Gesundheitssystem und unzureichender Finanzierung der Entwicklung. Es gab in den letzten Jahren bedeutende technologische Durchbrüche und viele der heute kommerziell international erfolgreichen Produkte basieren auf deutscher Innovationskraft und Technologie.

Fortschritt, Innovationskraft und verbesserte Gesundheitsversorgung führen aber auch zu steigenden Kosten im Gesundheitssystem. Eine logische Antwort darauf sind Biosimilars, die wir bei Formycon entwickeln. Diese biopharmazeutischen Nachfolgeprodukte ermöglichen es, hochwirksame Behandlungen zu deutlich niedrigeren Kosten anzubieten, was sowohl den Patienten als auch den Gesundheitssystemen zugutekommt. Die Bedeutung von Biosimilars wächst rasant und wird in den nächsten Jahren immer entscheidender, um den Zugang zu wirksamen Therapien zu verbessern und diese bezahlbar zu machen.

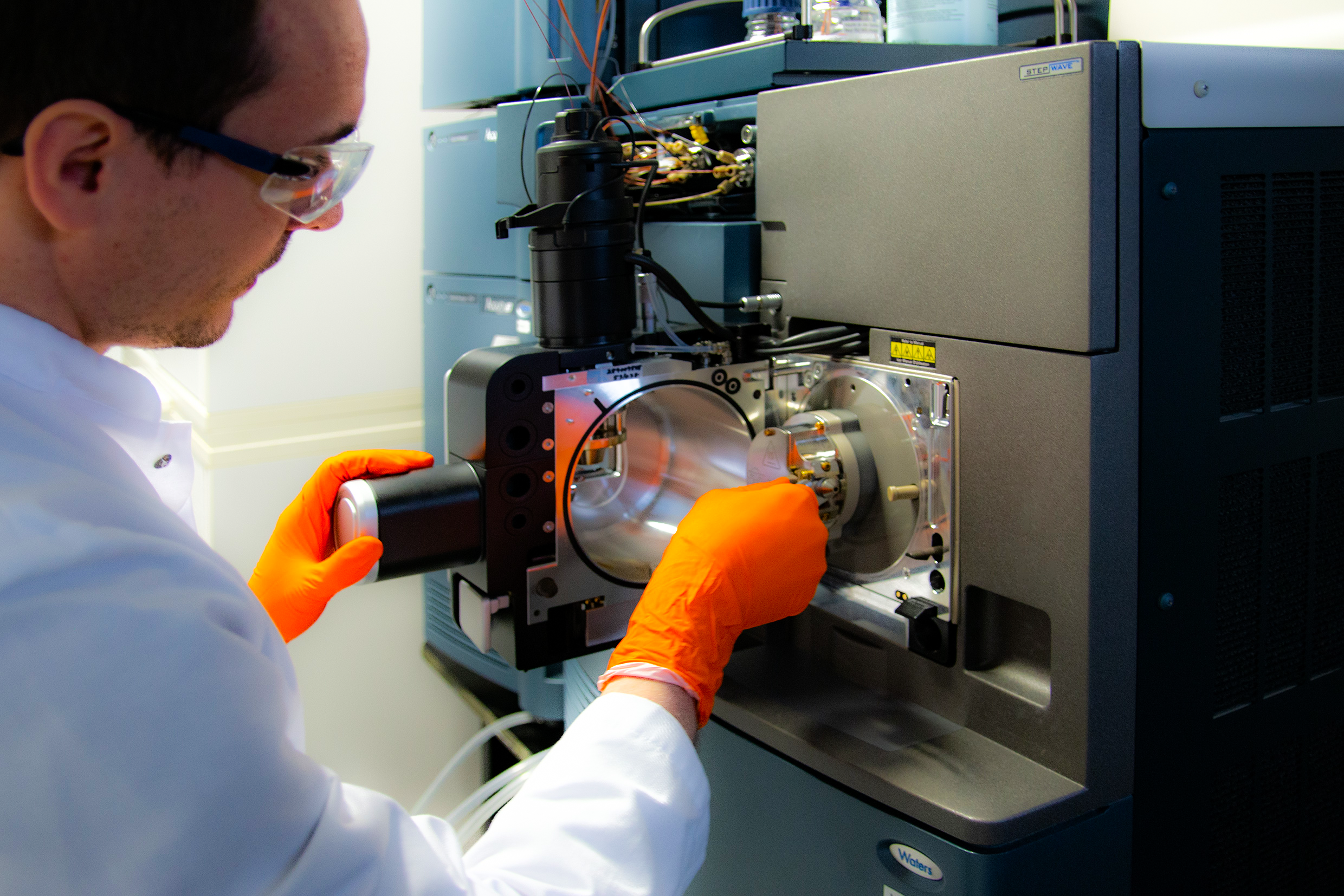

Die Entwicklung von Biosimilars ist komplex und erfordert jahrelange Forschung sowie hohe Investitionen bis zu ihrer Zulassung. Eine große technische und analytische Kompetenz sowie wissenschaftliche und regulatorische Expertise sind notwendig, um diesen Prozess erfolgreich zu meistern. Trotz der hohen Entwicklungskosten profitieren Biosimilar-Entwickler nicht von Exklusivitätsrechten, was den Margendruck erhöht. Deshalb müssen diese Unternehmen besonders effizient arbeiten, um im direkten Wettbewerb bestehen zu können. In einem Umfeld, in dem es keinen Patentschutz gibt, zählt jeder Tag und jeder Euro.

Der Erfolg eines Biosimilar-Unternehmens und insbesondere von Formycon basiert auf einem erfahrenen Entwickler-Team und einer klaren strategischen Planung bei der Auswahl der Kandidaten. Die enge Abstimmung zwischen Forschung, Entwicklung, Regulatorik und Vermarktung ist entscheidend, um ein Biosimilar erfolgreich auf den Markt bringen zu können. Bei Formycon haben wir gezeigt, wie wichtig es ist, auf die richtige Kombination aus Know-how und Erfahrung zu setzen. Unser Team hat sich in den letzten fünf Jahren auf rund 240 Mitarbeitende verdoppelt und wir haben all unsere geplanten Meilensteine erreicht: darunter die Zulassung und erfolgreiche Markteinführung unseres ersten Biosimilars in globalen Schlüsselmärkten sowie Zulassungen der FDA und EC für weitere Biosimilars in diesem Jahr.

Für Formycon ist die Auswahl der Partner – vor allem in den Bereichen Herstellung und Vermarktung – in diesem intensiven Wettbewerbsumfeld extrem wichtig, um Marktanteile und Margen zu sichern und den Markt mit hochqualitativen Biosimilars zu durchdringen. Die erfolgreiche Vermarktung und daraus resultierende Produktumsätze sichern in den nächsten Jahren einen Teil der Investitionen in unsere vielversprechende und diverse Pipeline von Biosimilars der nächsten Generation, wie z. B. für die dieses Jahr gestartete Entwicklung von Pembrolizumab.

Unser Erfolg basiert auf einer Mischung aus wissenschaftlicher Expertise, Marktintelligenz, Agilität, Flexibilität und Kostensensitivität, um im hart umkämpften Biosimilar-Markt zu wachsen und langfristig zu bestehen. Dies gilt auch für die deutsche Biotechnologie-Branche, die einem starken internationalen Wettbewerb ausgesetzt ist. Umso wichtiger ist die Arbeit von BIO Deutschland, die Interessen zu bündeln und sich für besser Rahmenbedingungen sowie Unterstützung in Politik und Öffentlichkeit einzusetzen. Biotech ist Zukunftstechnologie, die auch in den nächsten 20 Jahren Innovationen vorantreiben wird, um die Herausforderungen der Gesundheitssysteme zu meistern.

Opening Bell Ceremony at the Frankfurt Stock Exchange

05. Oktober 2024

Dr. Stefan Glombitza, CEO of Formycon AG, and Enno Spillner, CFO of Formycon AG, speak at the opening bell ceremony about the imortant step of moving to the Prime Standard of the Frankfurt Stock Exchange. The speeches are in German.

Biosimilars on the rise

05. Oktober 2024

In the Effecten Spiegel financial podcast, Formycon CFO Enno Spillner talks about biosimilars, the market's growth prospects and Formycon's strategy and recent regulatory successes. The podcast is available in German.

An Interview with our Executive Board

13. August 2024

Formycon is regarded as a “pure play” biosimilars company. What exactly does this mean?

Dr. Stefan Glombitza

Chief Executive Officer (CEO)

Formycon AG

Dr. Stefan Glombitza, Chief Executive Officer: „Formycon is a globally operating, independent specialist in the development of biosimilar drugs. We aim to firmly establish our company as leader in the growing biosimilars segment and partner of choice for the major pharmaceutical names with their strength and reach in sales and marketing. For us, being a “pure play” specialist means complete and absolute focus on our capabilities and excellence spanning all phases of biosimilars development, from the process of selecting biosimilar candidates all the way through to regulatory approval.“

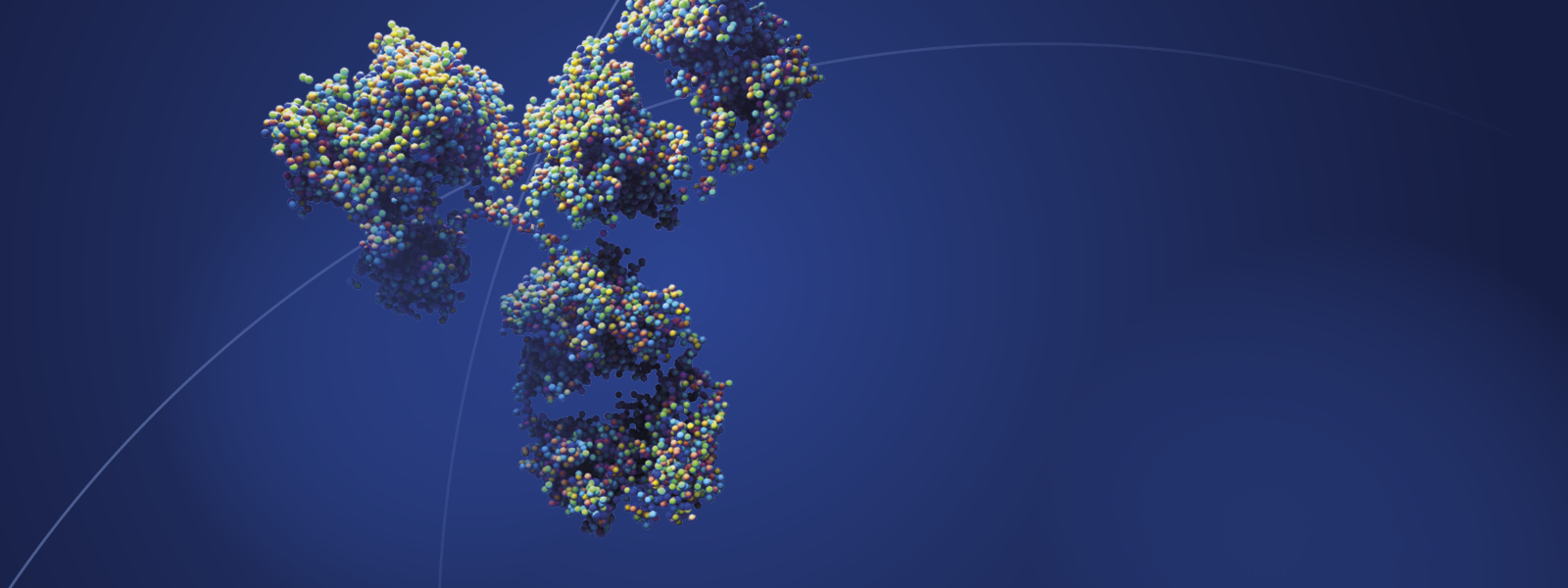

What makes you so confident that biosimilars are a growth market?

Stefan Glombitza: „Three reasons: firstly, the vast combined market size of the biologics which will lose their market exclusivity over the next few years; secondly, the large and ever increasing need for doctors to be able to effectively treat patients; and thirdly, the growing financial strains on the world’s healthcare systems. Because of the high cost of many biologics, it remains true even today that too few patients are being treated with these highly effective drugs at a sufficiently early disease stage. Biosimilars, with their comparable efficacy, represent a cost-effective solution to this global problem. Biosimilars can provide the financial relief so that as many patients as possible can receive the optimal therapy as early as possible. The “gold standard” for treating serious diseases should not be reserved for just the privileged few.“

Can you give us an example of a disease for which medical needs are not currently being fully met because there is, in fact, an undersupply of biologics?

Stefan Glombitza: „One of many examples is Crohn’s disease, a chronic inflammatory bowel disorder. Even in a rich country like Germany, only about 15% of Crohn’s patients are currently being treated with highly effective biologics.1 In the acute phases of Crohn’s disease, severe inflammatory symptoms often occur for periods of several weeks, severely impacting quality of life for those afflicted, including tremendous psychological stress. The treatment option is there, but it is being used too rarely. We want to change this – in this specific case with FYB202, our candidate biosimilar to Stelara®2, for which we expect EU approval shortly following the CHMP’s positive recommendation.3 As biosimilars like our FYB202 enter the market, competition increases, costs fall, and patient care improves.“

Formycon announced quite a number of development advances over the first six months of this year. Which of these were the highlights for you?

Stefan Glombitza: „At the start of the year, we said: In 2024 we will lay the foundation for the next phase of Formycon’s growth, which will lead us to sustainable profitability over the medium term, through the approval of biosimilars and preparations for their market launch by early 2025. We’re on track for this.

A particular highlight is certainly the FDA’s4 approval of FYB203, our biosimilar to Eylea®5. With this approval for the U.S. market of FYB203 – which, like our FYB201 product, can be used to treat serious retinal diseases such as “wet” age-related macular degeneration and various diabetes-related diseases – we are now even more strongly positioned in the ophthalmology sector.“

What about Formycon’s other biosimilar development projects?

Stefan Glombitza: „We’re coming along very well and in some cases are making progress even faster than anticipated. With the launch of clinical trials in June, we hope to secure a strong market position for FYB206, our candidate biosimilar to Keytruda®6. As a biosimilar to the world’s top-selling drug, the economic importance of this project can hardly be overstated. We see enormous future demand.

As to the FYB202 project which I mentioned before, we expect EU approval as early as the beginning of the fourth quarter of 2024, a few weeks ahead of our original plan, due in no small part to the superb work and quick response times of our development teams. In the United States, we likewise expect FDA approval for FYB202 around the end of September. In addition, we hope to begin work on FYB210, a new biosimilar candidate, in the second half of the year. In other words, you can look forward to more positive news from Formycon over the coming weeks and months.“

Dr. Glombitza mentioned the economic importance of FYB206 to Formycon. What more can you tell us about this?

Dr. Andreas Seidl

Chief Scientific Officer (CSO)

Formycon AG

Dr. Andreas Seidl, Chief Scientific Officer: „With this entry into immuno-oncology, we are opening up an area of active ingredients with extraordinarily large market potential. The IARC7 expects that worldwide cancer cases will continue to increase sharply in the future. The demand for these modern therapies is immense – so there’s a good reason why so many biosimilars are being developed for cancer treatment.“

How can FYB206 help cancer patients?

Andreas Seidl: „With FYB206, or pembrolizumab, we are developing a candidate biosimilar that works by activating the body’s own immune response to fight the tumor. This is a highly promising approach for numerous cancer indications, notably including non-small cell lung cancer and melanoma, a particularly aggressive form of skin cancer. These are, in fact, the two specific indications for which we are currently conducting our clinical trials.“

Top-selling reference drugs generally mean a lot of potential competitors in the biosimilars market space. Where do you see Formycon in this competition?

Andreas Seidl: „The start of clinical trials is a good indicator for comparing our own development progress to that of our competitors. All in all, we can be very satisfied by this metric because it means that we are in the leading tier of biosimilar developers, particularly within the target markets of the United States and Europe.“

So both of these clinical trials are already in progress?

Andreas Seidl: „Yes, the two clinicals studies are being conducted in parallel across several centers in Eastern Europe and Southeast Asia. In mid-June, we launched the Dahlia phase I study, comparing the pharmacokinetics, safety and tolerability of FYB206 with the reference drug Keytruda®. Study participants are patients who have had a malignant melanoma surgically removed.

For the Lotus phase III study, we recruited patients with non-small cell lung cancer and began the actual clinical trials starting from the end of July. The Lotus study compares the safety and efficacy of FYB206 to its reference drug Keytruda®.

I know that a lot is also happening in the area of commercialization. What are Formycon’s current priorities?

Nicola Mikulcik

Chief Business Officer (CBO)

Formycon AG

Nicola Mikulcik, Chief Business Officer: „Our FYB201 product, the biosimilar to Lucentis®8, also known as ranibizumab, is already available in 19 countries worldwide. In the United States and various other markets, we are pleased with the very good market penetration we’ve already achieved, and we are clearly leading in ranibizumab biosimilars. And the market launches are continuing: Most recently, we were able to announce the launch in Saudi Arabia through our commercialization partner MS Pharma. Further approvals and product launches are planned through to 2026, with a particular regional focus on Middle Eastern and Latin American markets.“

How have the European markets been developing?

Nicola Mikulcik: „We are working hard to further expand our market share within Europe. The introduction of pre-filled syringes to complement the currently available vials will play a key role in these efforts. This more convenient dosage form should be available to doctors and eye clinics over the course of the coming year.“

FYB202 and FYB203 are both approaching the commercialization stage. What are the next steps as you prepare for market introduction?

Nicola Mikulcik: „In the case of FYB202, our candidate biosimilar to Stelara®, we’re focusing on the initial market launches together with our marketing partner Fresenius Kabi and working hard to ensure that the product is available in sufficient quantities starting with the United States and Europe.

For our second ophthalmology biosimilar, FYB203, our partner and license holder Klinge Biopharma has concluded an exclusive license and supply agreement with MS Pharma for marketing in the MENA region. MS Pharma is very well positioned throughout this region and has already been successfully introducing our FYB201 product in these markets.

As to the United States and Europe, we expect to conclude corresponding agreements with strong commercialization partners in the second half of the year.“

How is 2024 looking so far from a financial perspective?

Enno Spillner

Chief Financial Officer (CFO)

Formycon AG

Enno Spiller, Chief Financial Officer: „The entry of Gedeon Richter as a strategic investor at the start of the year was a major statement of confidence. For us, this was not only a big success as a transaction but also a validation of our growth path and remarkable achievements over the past few years.

The cash inflow from this transaction of roughly € 83 million has made a significant contribution to our capacity to continue pushing forward with our biosimilar development projects, particularly FYB206, at a consistently rapid pace while also ensuring the highest quality standards.“

In the case of two biosimilar candidates, development is almost complete. What are your expectations for FYB202 and FYB203?

Enno Spillner: „As of now, we are fully on schedule with all of our development projects and are looking forward to the launch of FYB202, our candidate biosimilar to Stelara®, in 2025. Once the global market launch by our commercialization partner Fresenius Kabi is complete, FYB202 will significantly increase Formycon’s sales revenue and help us attain sustainable EBITDA profitability over the medium term. The settlement agreements with Johnson & Johnson have paved the way not only for the U.S. market but also, more recently, for the European and Canadian markets.

We cannot currently give a specific launch date for FYB203, as no agreement has yet been reached with Regeneron, the manufacturer of the reference drug.“

You’ve just issuance an upward revision to your guidance for fiscal year 2024. This is certainly a very positive signal. What were the triggers?

Enno Spillner: „Our current 2024 operating figures are looking good, and everything is going according to plan. Sales and EBITDA are expected to remain within the forecast range. We were pleased to be able to announce a significant upward adjustment to our Adjusted EBITDA forecast due to better-than-expected results from sales of FYB201, which are reported through our investment participation in the Bioeq AG joint venture. These ongoing earnings will make a sustained contribution to our company’s success.“

In summary, it’s clear from everything you’ve said that the first half of 2024 was very successful. Would you say that the path to future success is also clear?

Dr. Stefan Glombitza: „Our path to becoming a globally leading, independent, pure-play biosimilars specialist is supported by a deep personal commitment from the entire #TeamFormycon. This extends to the members of the Supervisory Board with their extensive industry experience not only in Germany but internationally.

On this subject, I would like to once again extend our deepest gratitude to Dr. Olaf Stiller and Peter Wendeln, the two Supervisory Board members who stepped down in June after having done so much to help us to reach where we are today. With remaining members Wolfgang Essler and Klaus Röhrig as well as newly elected members Dr. Bodo Coldewey and Nick Haggar, along with Colin Bond starting from October 2024, we aim to continue Formycon’s successful path but with an increasingly international orientation.

On behalf of the Executive Board, I would like to specially thank our employees. Without the extraordinary efforts of the entire team, the many remarkable successes achieved during the first half of 2024 would not have been possible. We are also grateful to our shareholders for their continued confidence in Formycon and in the work that we do.“

Thank you for taking the time to speak with us!

- Baumgart, Misery, Naeyaert, Taylor: Biological Therapies in Immune-Mediated Inflammatory Diseases: Can Biosimilars Reduce Access Inequities?

- Stelara® is a registered trademark of Johnson & Johnson

-

The opinion of the Committee for Medicinal Products for Human Use (CHMP) of the EMA is the basis for the European Commission’s marketing authorization decision

- US regulatory authority – U.S. Food and Drug Administration

- Eylea® is a registered trademark of Regeneron Pharmaceuticals Inc.

- Keytruda® is a registered trademark of Merck Sharp & Dohme LLC.

- IARC – International Agency for Research on Cancer

- Lucentis® is aregistered trademark of Genentech Inc.

Karriere__N4

Ihre Bewerbung

Gut zu wissen

Sie überlegen, Teil von #TeamFormycon zu werden? Hier finden Sie Antworten auf häufige Fragen rund um Bewerbung, Einstieg und Arbeiten bei Formycon.

Bewerbungsprozess und Ablauf

Bitte nutzen Sie für Ihre Bewerbung unsere Karriereseite, damit sie direkt das richtige Team erreicht. Um Sie und Ihre Stärken besser kennenzulernen, füllen Sie bitte das Bewerbungsformular vollständig und sorgfältig aus. Ein persönliches Anschreiben hilft uns, mehr über Ihre Motivation zu erfahren. Denken Sie bitte daran, alle wichtigen Unterlagen wie Lebenslauf und Zeugnisse beizufügen. Folgende Dateiformate (bis 15 MB) sind möglich: PDF, Word, Open Office, HTML, RTF, JPG, PNG, GIF und Textdateien. Wir freuen uns auf Ihre Bewerbung!

Ja, selbstverständlich können Sie sich auf mehrere Positionen gleichzeitig bewerben. Bitte reichen Sie für jede Stelle eine eigene, vollständige Bewerbung ein – so können wir Ihre Unterlagen gezielt der jeweiligen Position zuordnen und eine zügige Bearbeitung sicherstellen.

Sie können dabei gerne dieselben Dokumente verwenden. Überlegen Sie jedoch im Vorfeld, welche Positionen wirklich zu Ihnen und Ihren beruflichen Zielen passen.

Sollten Sie mehrere Bewerbungen einreichen, kann es im Gespräch vorkommen, dass wir nach Ihren Präferenzen fragen – einfach, um gemeinsam herauszufinden, wo Sie sich am besten entfalten können.

Unser Bewerbungsprozess umfasst in der Regel zwei Gesprächsrunden. Das erste Kennenlernen findet bequem per Videocall statt. Wenn wir das Gefühl haben, dass wir gut zueinander passen, laden wir Sie herzlich zu einem zweiten Gespräch an unseren Standort in Martinsried ein – denn der persönliche Austausch ist uns besonders wichtig.

Die Terminabstimmung und alle weiteren Informationen erhalten Sie direkt von unserem Recruiting-Team. Bitte beachten Sie, dass offizielle Einladungen ausschließlich über unsere E-Mail-Domain versendet werden. Sollten Sie eine Einladung von einem anderen Absender erhalten, melden Sie sich gerne bei uns zur Klärung.

Damit Ihre Bewerbung schnell und sicher bei uns ankommt, bitten wir Sie, sich ausschließlich über unsere Karriereseite zu bewerben. Von Bewerbungen per Post oder E-Mail bitten wir abzusehen – so können wir einen reibungslosen Ablauf für alle Bewerbenden gewährleisten.

In der Regel reicht es vollkommen aus, wenn Sie Ihre Bewerbung über unser System einreichen. Wir erwarten nicht, dass Sie zusätzlich die Personalabteilung oder die einstellende Führungskraft kontaktieren, um Ihr Interesse zu bekunden. Sollten Sie jedoch aus organisatorischen Gründen, wie beispielsweise der Terminverschiebung für ein Vorstellungsgespräch, Kontakt aufnehmen wollen, können Sie dies selbstverständlich jederzeit tun.

Wir bemühen uns, Ihre Bewerbung so schnell wie möglich zu bearbeiten, da wir wissen, wie wichtig eine zeitnahe Rückmeldung ist. Der genaue Ablauf und die Dauer des Prozesses können jedoch je nach Position und den jeweiligen internen Abläufen variieren.

Eine nachträgliche Änderung über das System ist leider nicht möglich. Sollten jedoch grobe Fehler in Ihrer Bewerbung vorliegen oder möchten Sie etwas ergänzen, antworten Sie einfach auf die Eingangsbestätigung Ihrer Bewerbung. Wir helfen Ihnen gerne weiter und finden eine Lösung!

Für Ihre Bewerbung benötigen wir mindestens einen aussagekräftigen Lebenslauf. Gern können Sie diesen um Zeugnisse oder Zertifikate ergänzen – so bekommen wir ein vollständiges Bild Ihrer Qualifikationen. Auch ein kurzes Motivationsschreiben ist willkommen, vor allem, wenn Sie uns noch mehr über sich erzählen möchten, als der Lebenslauf verrät. Wir freuen uns darauf, mehr über Sie zu erfahren!

Karriere und Einstieg

Selbstverständlich können Sie sich auch jederzeit initiativ bei uns bewerben. Wir freuen uns immer über engagierte Bewerbungen, auch wenn aktuell keine passende Stelle ausgeschrieben ist. Bitte nutzen Sie hierfür einfach unser Online-Bewerbungssystem [Link]. Dort können Sie Ihre Unterlagen einreichen und uns mitteilen, in welchem Bereich Sie sich eine Mitarbeit bei uns vorstellen können. Wir prüfen Ihre Bewerbung und melden uns, sobald eine passende Gelegenheit entsteht.

In der Regel suchen wir nach Bewerberinnen und Bewerbern mit sehr spezialisierten Fachkenntnissen, da unsere Positionen oft spezifische Anforderungen haben. In Einzelfällen kann auch ein Quereinstieg möglich sein, wenn Ihre Erfahrungen und Fähigkeiten gut zu der Position passen.

Ja, Formycon bietet engagierten Studierenden die Möglichkeit, praktische Erfahrungen in einem innovativen Umfeld zu sammeln – etwa im Rahmen von Praktika, Werkstudierendenstellen oder Abschlussarbeiten. Diese Positionen sind jedoch nur in begrenzter Anzahl verfügbar und werden auf unserer Karriereseite ausgeschrieben. Sollte dort aktuell keine passende Stelle zu finden sein, freuen wir uns über eine Initiativbewerbung und prüfen gerne individuell, ob ein Einsatz möglich ist.

Karriere beginnt nicht erst mit der Führungsposition – sie beginnt mit dem ersten Schritt. Egal, wo Sie heute stehen: Bei Formycon finden Sie vielfältige Möglichkeiten, sich beruflich und persönlich weiterzuentwickeln. Ob klassische Führungslaufbahn oder spezialisierte Fachkarriere, z. B. in der Forschung & Entwicklung – in beiden Fällen gilt: Wir begleiten Sie auf Ihrem Weg und schaffen den Rahmen, in dem Sie Ihre Stärken entfalten können.

Arbeiten bei Formycon

Aktuell bieten wir leider keine Möglichkeiten, aus dem Ausland für Formycon zu arbeiten.

Bei Formycon bieten wir eine hohe Flexibilität, was das Arbeiten von verschiedenen Orten angeht. Während wir kein reines Homeoffice-Modell anbieten, haben unsere Mitarbeitenden die Freiheit, selbst zu entscheiden, wo sie am produktivsten sind. Sie können in unseren Büroräumen in Martinsried, Ihrem eigenen Zuhause, aber auch flexibel innerhalb Deutschlands arbeiten. Mobiles Arbeiten ist in vielen Bereichen eine großartige Option – lediglich in spezialisierten Bereichen, wie zum Beispiel dem Labor, ist dies nur eingeschränkt möglich.

Der Arbeitsalltag bei Formycon hängt stark davon ab, in welchem Bereich Sie tätig sind. Eine pauschale Antwort gibt es daher nicht. Wenn Sie jedoch einen guten Eindruck von den verschiedenen Arbeitswelten bei uns bekommen möchten, werfen Sie gerne einen Blick auf die Erfahrungsberichte unserer Mitarbeitenden. Dort teilen Kolleginnen und Kollegen aus unterschiedlichen Bereichen ihre Einblicke – take a look [Link]!

Bei uns arbeiten Sie eigenverantwortlich und haben die Flexibilität, Ihre Arbeitszeit nach Ihren Bedürfnissen zu gestalten. Die reguläre Arbeitszeit in Vollzeit beträgt bei Formycon 40 Stunden pro Woche. Grundlage ist ein Jahresarbeitszeitkonto, das Ihnen zusätzliche Flexibilität in der Gestaltung Ihres Arbeitsalltags ermöglicht.

Auch wenn wir keine Kantine haben, bieten wir Ihnen den „Foodji“ – einen praktischen Essensautomaten, der eine bunte Auswahl an warmen Mahlzeiten, Snacks und Getränke bereithält. So können Sie sich jederzeit schnell und unkompliziert während des Arbeitstags stärken. Darüber hinaus gibt es für unsere Mitarbeitenden kostenfrei Wasser und Kaffee. In der näheren Umgebung finden Sie zudem ein vielfältiges und leckeres Essensangebot, sodass Sie ganz nach Lust und Laune auswählen können.

Ja, bei uns wird nicht nur das Mittagessen, sondern auch das Frühstück, Getränke und Snacks im „Foodji“ bezuschusst. So können Sie sich während des Arbeitstags ganz unkompliziert und zu attraktiven Preisen stärken.

Technische und organisatorische Fragen

Wenn Sie uns eine Bewerbung über unsere Webseite zukommen lassen, verarbeiten wir Ihre damit verbundenen personenbezogenen Daten entsprechend den Vorschriften des Bundesdatenschutzgesetzes. Details dazu, sowie unsere aktuellen Datenschutzbestimmungen finden Sie hier: [Link]. Formycon löscht nach Abschluss des Bewerbungsverfahrens automatisch alle personenbezogenen Daten. Die entsprechenden Löschfristen richten sich nach den gesetzlichen Bestimmungen des Landes.

Bei Fragen steht Ihnen unser Recruiting-Team von Formycon jederzeit gerne zur Verfügung. Sie erreichen uns einfach und unkompliziert per E-Mail.

Die Formycon AG hat ihren Sitz in Martinsried-Planegg, im südwestlichen Teil von München, eingebettet im bedeutenden Biotech-Cluster von Oberbayern. Eine detaillierte Anfahrtsbeschreibung finden Sie hier, um Ihre Anreise zu uns so einfach wie möglich zu gestalten.

Wir erstatten gerne die Fahrtkosten in Höhe eines 2. Klasse-Tickets der Deutschen Bahn für Hin- und Rückfahrt. Leider können wir Hotelkosten sowie Fahrtkosten innerhalb des Münchener Einzugsgebiets (Umkreis 30 km) nicht übernehmen. Wir hoffen jedoch, dass Ihre Anreise zu uns angenehm verläuft und stehen für weitere Fragen jederzeit zur Verfügung.

Für externe Partner

Wir bei Formycon arbeiten bereits mit einem bestehenden Netzwerk aus Personalvermittlungsagenturen zusammen. Wenn Sie uns passende Profile vorstellen möchten, können Sie dies ganz einfach über unser Online-Stellenportal auf der Formycon-Website tun. Klicken Sie einfach bei dem Stellenangebot auf „Bewerben“, setzen ein Häkchen im Kästchen „Für Personalberatung“ und geben die Agenturdetails ein. Anschließend können Sie die Unterlagen des Bewerbenden hochladen und mit „Senden“ an uns übermitteln. Falls das Kästchen nicht vorhanden ist, ist die Stelle nicht für Agenturen freigegeben. Bitte beachten Sie, dass wir Vermittlungsvorschläge von Personalvermittlern, die nicht über unser Online-Portal und ohne vorherige Absprache eingereicht werden, leider nicht berücksichtigen können.

Falls Sie Interesse an einer Zusammenarbeit haben, setzen Sie sich gerne mit unserem Recruiting-Team in Verbindung. Unsere Allgemeinen Geschäftsbedingungen für Personalberater, mit denen kein gültiger Vermittlungsvertrag besteht, finden Sie hier. Mit dem Hochladen eines Kandidatenprofils erklären Sie, diese zu akzeptieren.

Noch etwas unklar?

Dann melden Sie sich gerne

direkt bei unserem Recruiting-Team –

wir sind für Sie da.

Karriere__N3

Benefits

Ihre Arbeit ist wertvoll!

Unsere Benefits sind ein Zeichen

unserer Wertschätzung.

Engagierte und motivierte Mitarbeitende

sind der Schlüssel zu unserem Erfolg. Deshalb liegt uns Ihr

Wohlbefinden und Ihre Gesundheit besonders am Herzen.

Neben einer attraktiven Vergütung, 30 Tagen Urlaub und der Möglichkeit zum hybriden Arbeiten freuen wir uns vor allem auf das, was darüber hinausgeht: Wir unterstützen Sie aktiv bei Ihrer persönlichen und fachlichen Weiterentwicklung, fördern Ihre Gesundheit und bieten Ihnen mit der Formycon-Card ein echtes Extra. Wir möchten, dass Sie sich bei uns wohlfühlen und sich kontinuierlich weiterentwickeln können – gemeinsam gestalten wir eine erfolgreiche Zukunft!

Klicken Sie sich durch unsere Benefits und entdecken Sie,

was wir alles für Sie bereit halten:

Weiterkommen? Gestalten wir gemeinsam.

Entdecken Sie Ihre Potenziale und wachsen Sie täglich über sich hinaus! Ob Seminar, Kongress oder Vortrag – wir fördern Ihre fachliche und persönliche Entwicklung gezielt und praxisnah. Ihre Interessen und Stärken stehen dabei im Mittelpunkt. Mit neuem Wissen und frischen Impulsen bringen Sie innovative Ideen direkt in spannende Projekte ein und gestalten aktiv Ihre Zukunft.

Energiegeladene Pausen

Ob Kaffee, Tee, frisches Obst oder gesunde Snacks – bei Formycon ist für Ihr Wohl gesorgt. Unsere subventionierten Pausenangebote laden zum Auftanken ein: Der moderne Foodji-Automat bietet neben Snacks auch abwechslungsreiche Mittagessen – frisch, gesund und direkt vor Ort. So bleiben Sie konzentriert, fit und voller Energie – den ganzen Tag über.

Gesund bleiben – bei Formycon ein Benefit

Mit unserem umfassenden Gesundheitsangebot unterstützen wir Ihr Wohlbefinden und unterstützen Sie dabei, gesund zu bleiben. Unser Betriebsarzt kümmert sich direkt vor Ort um Impfungen und Check-ups. Außerdem profitieren Sie von Rabatten für Fitnessstudios und haben Zugang zu einer Plattform für mentale Gesundheit, inklusive psychologischer Online-Beratung.

Die Formycon-Card

Zusätzlich zu Ihrem Gehalt laden wir monatlich Ihre Formycon Prepaid-Kreditkarte auf. Ausgestattet mit unserem Logo, ist die Karte in der Region München weit verbreitet und bietet Ihnen ein praktisches Zahlungsmittel für den Alltag. Nutzen Sie die Karte ganz flexibel – weitere Informationen, wo Sie sie einsetzen können, finden Sie hier:

Flexibel arbeiten – gemeinsam erfolgreich

Hybrides Arbeiten verbindet das Beste aus beiden Welten: konzentriertes Arbeiten von zu Hause und kreativer Austausch im Büro. So bleiben wir flexibel, effizient und im engen Kontakt miteinander.

Work-Life-Balance, die passt!

Engagement im Arbeitsalltag braucht Raum zur Erholung: 30 Tage Urlaub, flexible Planung, Freizeitausgleich und freie Tage an Weihnachten und Silvester – bei uns lässt sich Arbeit gut mit Auszeit verbinden.

Sicher in die Zukunft – heute und morgen

Bei Formycon unterstützen wir Ihre Altersvorsorge großzügig – mit bis zu 50% des Entgeltumwandlungsbetrags, statt der gesetzlich vorgeschriebenen 15%. Darüber hinaus bieten Ihnen auf Wunsch eine persönliche, unabhängige Beratung.

Willkommen, von Anfang an

Bei uns starten Sie nicht einfach – Sie kommen an. Unser strukturierter Onboarding-Prozess begleitet Sie über sechs Monate hinweg mit festen Meilensteinen und regelmäßigen Feedbackgesprächen. Ein persönlicher Mentor aus Ihrem Fachbereich steht Ihnen dabei von Beginn an zur Seite. So finden Sie sich schnell zurecht – fachlich wie menschlich.

Globales Team, gemeinsame Mission

Bei Formycon arbeiten Sie in einem vielfältigen, internationalen Team, das durch Offenheit, Vernetzung und zahlreiche Perspektiven geprägt ist. Unsere Mitarbeitenden kommen aus vielen verschiedenen Ländern, was uns eine einzigartige, multikulturelle Arbeitsumgebung bietet.

Sicherheit geht vor

Ob Sommerfeste, Weihnachtsfeiern, Jubiläumsfeiern, Teamevents oder Dachterrassen-Partys – bei uns gibt es das ganze Jahr etwas zu feiern. Dabei sind Ihre Ideen für gemeinsame Erlebnisse im Team immer willkommen!

Für den Notfall gewappnet

Wir bieten unseren Formycon-Mitarbeitenden einen praxisnahen Erste-Hilfe-Kurs an – direkt vor Ort. So sind Sie im Ernstfall bestens vorbereitet und können schnell und richtig handeln.

Mehr als nur Weihnachten feiern

Ob Sommerfeste, Weihnachtsfeiern, Jubiläumsfeiern, Teamevents oder Dachterrassen-Partys – bei uns gibt es das ganze Jahr etwas zu feiern. Dabei sind Ihre Ideen für gemeinsame Erlebnisse im Team immer willkommen!

So stellen Sie sich

Ihren Arbeitgeber vor?

Dann sind Sie bei Formycon genau richtig. Wir bieten Ihnen ein wertschätzendes Umfeld, echte Benefits und die Chance, Ihr Potenzial voll zu entfalten. Wir freuen uns darauf, Sie kennenzulernen!

Karriere__N2

Arbeiten bei Formycon

One Team – One Purpose

Bei Formycon arbeiten Menschen aus mehr als 30 Nationen gemeinsam an einem Ziel: Weltweit Patienten und Patientinnen den Zugang zu lebenswichtigen Therapien zu ermöglichen. Lernen Sie unser Unternehmen und das #TeamFormycon kennen!

Wir sind #TeamFormycon!

Bei uns ist jede und jeder Einzelne mehr als nur ein Mitarbeitender – bei uns sind Sie Teil eines Teams, das zusammen an einem wichtigen Ziel arbeitet: hochwirksame und bezahlbare Biosimilars für alle.

Kultur der vertrauensvollen Zusammenarbeit

Rund 250 engagierte Mitarbeitende aus mehr als 30 Nationen arbeiten im #TeamFormycon – davon rund 60 % Frauen und 40 % Männer. Über 80 % unserer Kolleginnen und Kollegen sind in der Forschung und Entwicklung tätig. Unsere Unternehmenskultur basiert auf Vertrauen, Transparenz und Verantwortung. Wir leben flache Hierarchien, offenen Austausch und gegenseitige Wertschätzung – vom Labor bis zur Vorstandsebene. Bei Formycon zählt Teamgeist mehr als Titel.

Wissenschaft mit Wirkung

Wir konzentrieren uns auf die Entwicklung hochwertiger Biosimilars. Bei uns verbinden sich Forschung und Sinnhaftigkeit zu einem klaren Ziel: weltweit den Zugang zu lebenswichtigen Therapien zu verbessern. Ihre Arbeit hat direkten Einfluss auf die Gesundheit vieler Menschen.

Nachhaltigkeit & Verantwortung

Wir übernehmen Verantwortung – gegenüber unseren Mitarbeitenden, der Gesellschaft und der Umwelt. Durch nachhaltige Prozesse reduzieren wir unseren ökologischen Fußabdruck, fördern soziale Gerechtigkeit und setzen auf verantwortungsvolle Unternehmensführung. Nachhaltigkeit ist für uns ein integraler Bestandteil unseres Selbstverständnisses als führender Biosimilar-Entwickler.

Flexibles Arbeiten & moderne Benefits

Hybrides Arbeiten, moderne Büros und Labore, betriebliche Gesundheitsförderung und weitere attraktive Benefits sorgen dafür, dass Sie Beruf und Privatleben gut vereinbaren können. Ihre Arbeit ist wertvoll – erfahren Sie, was Sie von uns erwarten können

Unsere Unternehmensbereiche

Bei Formycon finden Sie spannende Bereiche, in denen Sie Ihre Expertise einbringen und einen wichtigen Beitrag leisten können – einen, der weit über den eigenen Bereich hinaus wirkt. Erfahren Sie, wie Sie bei uns einen Unterschied machen können.

Research & Development

Hier schlägt unser wissenschaftliches Herz

In R&D treffen Forschung, Produktentwicklung sowie klinische und regulatorische Expertise aufeinander. Gemeinsam arbeiten unsere Teams daran, neue Biosimilars zu entwickeln und zur Marktreife zu bringen – effizient, lösungsorientiert und mit dem guten Gefühl, Leben zu verbessern.

Business Development

Den Markt im Blick, die Zukunft im Fokus

Ob Licensing, Supply Chain & Logistic, Procurement oder IP – unser Business Development ist vielfältig aufgestellt. Hier treiben wir strategische Partnerschaften voran, bereiten die Kommerzialisierung vor und schaffen die Basis für nachhaltiges Wachstum.

Enabling Functions

Wir geben Struktur, damit Ideen wachsen können

IT, Legal & Compliance, Finance & Controlling, HR, IR & Corp.Communications, Facility Management – unsere Enabling Functions sorgen dafür, dass alles rundläuft. Hier schaffen und sichern wir die Strukturen, die es uns ermöglichen, fokussiert und effizient als gesamtes #TeamFormycon an unseren Zielen zu arbeiten.

Exzellenz ist kein Ziel – sie ist unsere Haltung. Jeden Tag.

Exzellenz bedeutet für uns Verantwortung zu übernehmen – für unsere Arbeit, unser Handeln und die Wirkung, die wir mit unseren Medikamenten in der Welt erzielen. In einer Branche, in dem Vertrauen und erstklassige Wissenschaft entscheidend sind, stehen Verbindlichkeit und Transparenz im Zentrum unseres Handelns. Was uns täglich motiviert? Der Sinn unserer Arbeit – wir wissen, dass wir durch unser Tun Leben verändern.

Neugier ist der Antrieb unserer Innovationen.

Wir glauben an Wissenschaft, die weiterdenkt. Unsere Offenheit für neue Wege, kreative Ideen und echte Begeisterung für eine zukunftsorientierte Wissenschaft treiben uns an. Wir fördern eine Kultur, in der Wissen geteilt wird, Lernen selbstverständlich ist – und Verbesserung kein Ziel, sondern ein fortlaufender Prozess ist. Denn wer neugierig bleibt, bleibt in Bewegung.

Vielfalt macht uns stärker.

Unser internationales und diverses #TeamFormycon ist der Motor für unseren Erfolg. Menschen mit unterschiedlichen Perspektiven, Erfahrungen und Hintergründen sehen wir als Bereicherung. Wir leben eine Kultur, die Vielfalt nicht nur unterstützt, sondern aktiv fördert.

Bei uns steht der Mensch im Mittelpunkt – immer.

Wir begegnen einander mit Respekt, Vertrauen und echter Wertschätzung. Unsere gelebte Open-Door-Kultur steht für einen offenen Austausch auf Augenhöhe – wir hören zu, teilen Verantwortung und unterstützen uns gegenseitig. Wir sind überzeugt, dass dieses Miteinander der Nährboden für große Ideen und nachhaltige Erfolge ist.

Neugierig geworden?

Entdecken Sie unsere aktuellen Stellenangebote und werden Sie Teil von #TeamFormycon. Wir freuen uns darauf, Sie kennenzulernen – als Mensch, als Talent, als Mitgestalter:in.

Karriere__N1

Karriere

Change Life for the Better

Wir bei Formycon arbeiten daran, den Zugang zu hochmodernen und erschwinglichen Arzneimitteln weltweit zu verbessern. Was uns als Team verbindet? Ein starkes Wir-Gefühl, die Begeisterung für zukunftsweisende Medizin und die Überzeugung, den Unterschied zu machen.

Gemeinsam Gesundheit gestalten – wissenschaftlich stark, menschlich verbunden. Werden auch Sie Teil von #TeamFormycon.

Wir sind Formycon. Bei uns treffen Begeisterung für Medizin und den Menschen auf eine starke Unternehmenskultur. Wir kombinieren wissenschaftliche Exzellenz mit gesellschaftlicher Verantwortung. Als führendes, konzernunabhängiges Unternehmen in der Entwicklung hochwertiger Biosimilars bieten wir nicht nur innovative Lösungen für die Gesundheitsversorgung von morgen – wir schaffen auch ein Arbeitsumfeld, in dem Ihre Ideen zählen, Ihr Beitrag Wirkung zeigt und Ihre Entwicklung im Fokus steht.

Erfahren Sie mehr ...

Update account details

Bond 2025

Update securities account details

Please read the disclaimer first!

The documents and information contained on the following websites are not directed at or to be accessed by persons located in the United States of America (“United States” or “U.S.”), Canada, Australia or Japan or any jurisdiction in which the distribution or release would be unlawful. These materials and information do not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States, Canada, Australia or Japan or any other jurisdiction in which such offer or solicitation is not authorized or to any person to whom it is unlawful to make such offer or solicitation.

In particular, the information on the following web pages is not an offer of securities for sale in the United States. The securities described on those pages have not been and will not be registered under the U.S. Securities Act of 1933, as amended (“Securities Act”). The securities may not be offered or sold in the United States absent registration or an exemption from the registration requirements of the Securities Act. There will be no public offer of the securities in the United States.

For users located in the United Kingdom

The documents and information contained on the following websites may only be accessed in the United Kingdom by persons who are “qualified investors” within the meaning of Article 2(e) of Regulation (EU) 2017/1129 of the European Parliament and of the Council of June 14, 2017, as amended (“Prospectus Regulation”) as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 who are also (i) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (“Order”) or (ii) high net worth companies, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”). The securities are only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such securities will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on these materials or this information or any of its content.

For users located within the European Economic Area

The documents and information contained on the following websites may only be accessed by persons located or resident in a member state of the European Economic Area (“EEA”) (other than Germany and Luxembourg) who are “qualified investors” within the meaning of Article 2(e) of the Prospectus Regulation. Further, if you are acting as a fiduciary or agent for one or more investor accounts, (a) each such account is a qualified investor, (b) you have investment discretion with respect to each account, and (c) you have full power and authority to make the representations, warranties, agreements and acknowledgements herein on behalf of each such account.

Viewing the materials and information you seek to access may not be lawful in certain jurisdictions. In other jurisdictions, only certain categories of persons may be allowed to view such materials. Any person who wishes to view these materials must first satisfy themselves that they are not subject to any local requirements that prohibit or restrict them from doing so.

If you are not permitted to view the documents and information contained on the following websites or are in any doubt as to whether you are permitted to view these materials or this information, please exit this website.

Basis of access

Access to electronic versions of the documents and information contained on the following websites is being made available by Formycon AG (“Company”) in good faith and for information purposes only. Making these documents and this information available in electronic format on the following websites does not constitute an offer to sell or the solicitation of an offer to buy securities in the Company. Furthermore, it does not constitute a recommendation by the Company or any other party to buy or sell securities in the Company. You agree that the materials you receive are for your own use and that you will not distribute the materials to any other person.

Confirmation of understanding and acceptance of disclaimer

By clicking on the “I AGREE“ button, I certify that:

- I am not located in the United States, Canada, Australia or Japan or any jurisdiction in which accessing the following materials would be unlawful;

- if I am located in the United Kingdom, I am a “relevant person” (as defined above); and

- if I am located in the EEA (other than Germany and Luxembourg), I am a “qualified investor” (as defined above)

I have read and understood the disclaimer set out above. I understand that it may affect my rights. I agree to be bound by its terms. By clicking on the “I AGREE” button, I confirm that I am permitted to proceed to electronic versions of these materials.

Contact

Formycon AG

Disclaimer_Exit

Disclaimer

Thank you for your interest!

We are grateful for your interest in Formycon AG. For legal reasons, we are unable to grant you access to the following information, as you have not confirmed that (I) you have read and accepted this notice and the restrictions in full, (II) that you are resident in Germany or Luxembourg, and (III) that you agree not to distribute, forward, or otherwise make the information contained on the following websites available to persons who are not resident in Germany or Luxembourg or who are not based there. Thank you for your understanding.

Disclaimer

Disclaimer

Disclaimer – Important!

The documents and information contained on the following websites are not directed at or to be accessed by persons located in the United States of America (“United States” or “U.S.”), Canada, Australia or Japan or any jurisdiction in which the distribution or release would be unlawful. These materials and information do not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States, Canada, Australia or Japan or any other jurisdiction in which such offer or solicitation is not authorized or to any person to whom it is unlawful to make such offer or solicitation.

In particular, the information on the following web pages is not an offer of securities for sale in the United States. The securities described on those pages have not been and will not be registered under the U.S. Securities Act of 1933, as amended (“Securities Act”). The securities may not be offered or sold in the United States absent registration or an exemption from the registration requirements of the Securities Act. There will be no public offer of the securities in the United States.

For users located in the United Kingdom

The documents and information contained on the following websites may only be accessed in the United Kingdom by persons who are “qualified investors” within the meaning of Article 2(e) of Regulation (EU) 2017/1129 of the European Parliament and of the Council of June 14, 2017, as amended (“Prospectus Regulation”) as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 who are also (i) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (“Order”) or (ii) high net worth companies, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”). The securities are only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such securities will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on these materials or this information or any of its content.

For users located within the European Economic Area

The documents and information contained on the following websites may only be accessed by persons located or resident in a member state of the European Economic Area (“EEA”) (other than Germany, Luxembourg and Austria) who are “qualified investors” within the meaning of Article 2(e) of the Prospectus Regulation. Further, if you are acting as a fiduciary or agent for one or more investor accounts, (a) each such account is a qualified investor, (b) you have investment discretion with respect to each account, and (c) you have full power and authority to make the representations, warranties, agreements and acknowledgements herein on behalf of each such account.

Viewing the materials and information you seek to access may not be lawful in certain jurisdictions. In other jurisdictions, only certain categories of persons may be allowed to view such materials. Any person who wishes to view these materials must first satisfy themselves that they are not subject to any local requirements that prohibit or restrict them from doing so.

If you are not permitted to view the documents and information contained on the following websites or are in any doubt as to whether you are permitted to view these materials or this information, please exit this website.

Basis of access

Access to electronic versions of the documents and information contained on the following websites is being made available by Formycon AG (“Company”) in good faith and for information purposes only. Making these documents and this information available in electronic format on the following websites does not constitute an offer to sell or the solicitation of an offer to buy securities in the Company. Furthermore, it does not constitute a recommendation by the Company or any other party to buy or sell securities in the Company. You agree that the materials you receive are for your own use and that you will not distribute the materials to any other person.

Confirmation of understanding and acceptance of disclaimer

By clicking on the “I AGREE“ button, I certify that:

- I am not located in the United States, Canada, Australia or Japan or any jurisdiction in which accessing the following materials would be unlawful;

- if I am located in the United Kingdom, I am a “relevant person” (as defined above); and

- if I am located in the EEA (other than Germany, Luxembourg and Austria), I am a “qualified investor” (as defined above)

I have read and understood the disclaimer set out above. I understand that it may affect my rights. I agree to be bound by its terms. By clicking on the “I AGREE” button, I confirm that I am permitted to proceed to electronic versions of these materials.

Test 2025

Test 2025

Hier steht eine Headline zum

Projekt Test

Hier steht ein Introtext: Lorem ipsum dolor sit amet, consectetur adipiscing elit. Phasellus auctor hendrerit sagittis. Nulla viverra malesuada nisi, quis sodales diam rutrum congue. Nunc rutrum eleifend nisl.

Eckdaten des Test

| Rechtsform | Aktiengesellschaft |

| Erstnotiz | 20. Dezember 2010 |

| ISIN | DE000A1EWVY8 |

| WKN | A1EWVY |

| Börsensegment | Regulierter Markt (Prime Standard) SDAX |

| Handelsplätze | Xetra, Berlin, Düsseldorf, Frankfurt, Hamburg, München, Stuttgart, Tradegate |

| Aktiengattung | Stückaktien o.N. |

| Grundkapital | 17.672.927,00 Euro |

| Anzahl der Aktien | 17.672.927 Stückaktien |

| Designated Sponsors | Oddo BHF Corporates & Markets AG M.M. Warburg & Co |

Testmöglichkeiten

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy eirmod tempor invidunt ut labore et dolore magna aliquyam erat, sed diam voluptua. At vero eos et accusam et justo duo dolores et ea rebum. Stet clita kasd gubergren, no sea takimata sanctus est Lorem ipsum dolor sit amet. Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy eirmod tempor invidunt ut labore et dolore magna aliquyam erat, sed diam voluptua. At vero eos et accusam et justo duo dolores et ea rebum. Stet clita kasd gubergren, no sea takimata sanctus est Lorem ipsum dolor sit amet.

Digitale Zeichnung

FAQ

In drei bis fünf Jahren sehen wir Formycon mit mindestens drei bzw. vier via Kommerzialisierungspartnern international vertriebenen Biosimilar-Produkten im Markt. Darüber hinaus wird unsere Produktpipeline weiter gereift und erweitert sein. Das Unternehmen ist zu einem international renommierten Biosimilar-Player avanciert und gründet auf soliden Finanzzahlen.

Im Gegensatz zu Generika, die durch eine chemische Synthese hergestellt werden und den absolut identischen Wirkstoff wie das ehemals patentgeschützte Präparat enthalten, werden Biosimilars mit Hilfe lebender Organismen produziert. Dies erfolgt meist in Zellkulturen wie beispielsweise in Bakterien, Hefezellen oder Säugetierzellen.1 Aus diesem Grund dauert eine Biosimilar-Entwicklung zwischen 7 und 10 Jahre2 (versus 2 bis 3 Jahre bei Generika3) und erfordert ein Budget zwischen 150 und 300 Mio. Euro3 (versus 5 bis 10 Mio. €3 bei einem Generikum).

Quellen:

1 Was sind eigentlich Biosimilars?

2 IQVIA Assessing the Biosimilar Void.

3 Schätzung des Unternehmens; Entwicklungszeiten und -kosten sind

je nach Indikation und Wirkstoffgruppe sehr unterschiedlich.

Unsere wichtigsten Assets sind unsere Pipelineprojekte, denn sie schaffen Werte. Daher wird unser Fokus auch weiterhin auf dem Ausbau der Plattform liegen. Wir planen derzeit alle 12 bis 18 Monate einen neuen Biosimilar-Kandidaten zu starten.

Wir evaluieren Kandidaten unabhängig von ihrem Indikationsgebiet. Der Schlüssel zu einer nachhaltigen und wertgenerierenden Plattform ist unserer Ansicht nach ein smarter Mix aus Nischen- und Blockbuster-Produkten bei der Auswahl der richtigen Kandidaten.

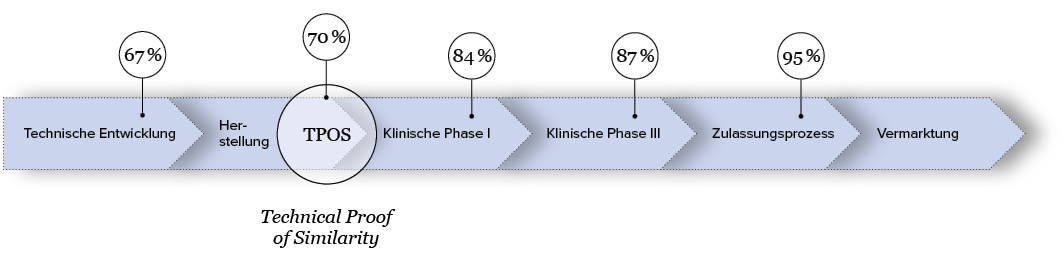

Die Wahrscheinlichkeit, dass ein Biosimilar erfolgreich zugelassen wird liegt bei etwa 95%, wenn man seine Hausaufgaben exakt und sorgfältig über die gesamte Entwicklungsdauer hinweg gemacht hat. Entscheidender Inflection Point ist der sogenannte Technical Proof of Similarity (TPOS). Ab hier steigt die Wahrscheinlichkeit einer erfolgreichen Zulassung von Phase zu Phase.

Quelle: The path towards a tailored clinical biosimilar development, Schiestl et. al 2020

Formycon setzt bisher KI-Tools ein, um interne Prozesse zu beschleunigen und effizienter zu gestalten. Auch bei der Produktentwicklung kann KI eingesetzt werden, insbesondere bei der effizienten Auswahl von Hilfsstoffen in der Formulierungsentwicklung und Optimierung der Stabilität von Formulierungen. Ebenso nutzen wir KI, um bessere Prognosen aus unseren Daten erhalten zu können. KI wird in Zukunft sicher eine noch größere Rolle in der Diagnostik spielen, sowohl im Rahmen von klinischen Studien als auch in der klinischen Praxis.

Im Vergleich zu großen Pharmaunternehmen sind wir in der Lage wie ein agiles Schnellboot zu agieren und uns den aktuellen Gegebenheiten schnell und wendig anzupassen. Das Besondere im Biosimilar-Bereich ist, dass Mitbewerber immer auch potenzielle Partner sein können. Was Formycon auszeichnet, sind die ausschließlich auf Biosimilars fokussierten Expert:innen, die bereits sehr viele Jahre Erfahrung in der Entwicklung und Zulassung von Biosimilars gesammelt haben und sämtliche Chancen und Herausforderungen entlang der Wertschöpfungskette bestens kennen. Hinzu kommt, dass es weit über 200 biologische Wirkstoffe gibt und kein Unternehmen all diese Wirkstoffe selbstständig entwickeln kann, auch die großen Pharmakonzerne nicht. Daher werden wir auch für diese stets ein attraktiver Partner sein.

Die Entwicklung dieser Arzneimittelklasse spricht klar für einen weiteren Uptake und eine weitere Etablierung von Biosimilars. Das zeigen die Einsparungen, die Biosimilars in den letzten Jahren erzielt haben. Im Global Use of Medicines Report von IQVIA wird prognostiziert, dass Biosimilars bis zum Jahr 2027 weltweit Einsparungen in Höhe von 290 Mrd. US-Dollar generieren werden. Diese Kosteneinsparungen eröffnen den Gesundheitssystemen an anderen Stellen wiederum mehr finanziellen Spielraum, weshalb sie einen wichtigen Beitrag zu einer nachhaltigen Gesundheitsversorgung leisten.

FYB201 wird unter dem Handelsnamen Ongavia® in Großbritannien, Ranopto® in Kanada und Ranivisio® in Europa sowie weiteren Ländern von Teva Pharmaceuticals Ltd. vertrieben. In den USA wird Cimerli® von Sandoz vermarktet und in der MENA-Region durch MS Pharma unter den Handelsnamen Uptera® und Ravegza®.

Für FYB202/Otulfi® wird unser Kommerzialisierungspartner für die globalen Schlüsselmärkte Fresenius Kabi sein.

Für FYB203 und weitere Biosimilar-Kandidaten wurden noch keine Kommerzialisierungspartnerschaften veröffentlicht.

Wir sehen uns als R&D Powerhouse mit einer voll skalierbaren Biosimilar-Entwicklungsplattform und fühlen uns in dieser Rolle sehr wohl. Dennoch ist Formycon auf Wachstum ausgerichtet, um sich als globaler Player im Bereich der Biosimilars zu etablieren. Hierzu gehört grundsätzlich auch die Prüfung von Opportunitäten anorganischen Wachstums entlang der Wertschöpfungskette.

Formycon ist ein auf Wachstum ausgerichtetes Unternehmen mit aktuell einem Produkt im Markt. Demnach ist es im Sinne einer nachhaltigen und wertschöpfenden Unternehmensentwicklung wahrscheinlich, dass wir die Rückflüsse in bestehende und neue Entwicklungsprojekte re-investieren werden und vorerst nicht planen, eine Dividende auszuschütten.

Kontakt

Formycon AG

Investor Relations Hotline: 089 864 667 112

E-Mail: ir@formycon.com